iedge s reit

The CSOP iEdge S-REIT Leaders Index ETF is not in any way sponsored endorsed sold or promoted by Singapore Exchange Limited andor its affiliates collectively SGX and SGX makes no warranty or representation whatsoever expressly or impliedly either as to the results to be obtained from the use of the iEdge S-REIT Leaders Index and. You can change your settings at any time.

Index Update Sgx S Iedge S Reit 20 Index Will Become The Iedge S Reit Leaders Index

Correspondingly the manager.

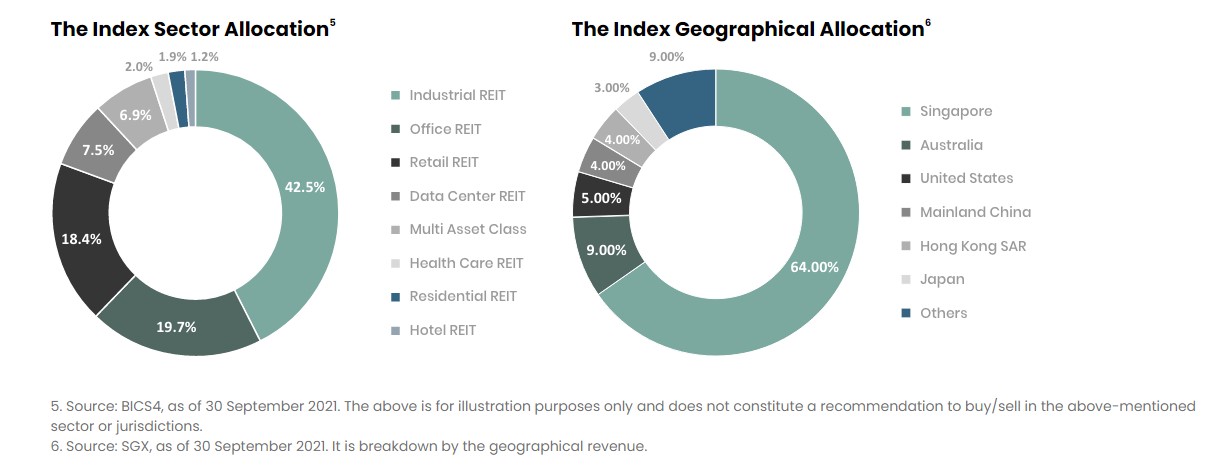

. ESR-Logos Reit was the only S-Reit which received both net institutional and retail inflows for Q1 2022. 7 rows Launched in 2014 the iEdge S-REIT Leaders Index is an index established to measure the. Proxied by iEdge S-REIT Leaders SGD Index Total Return 4 Source.

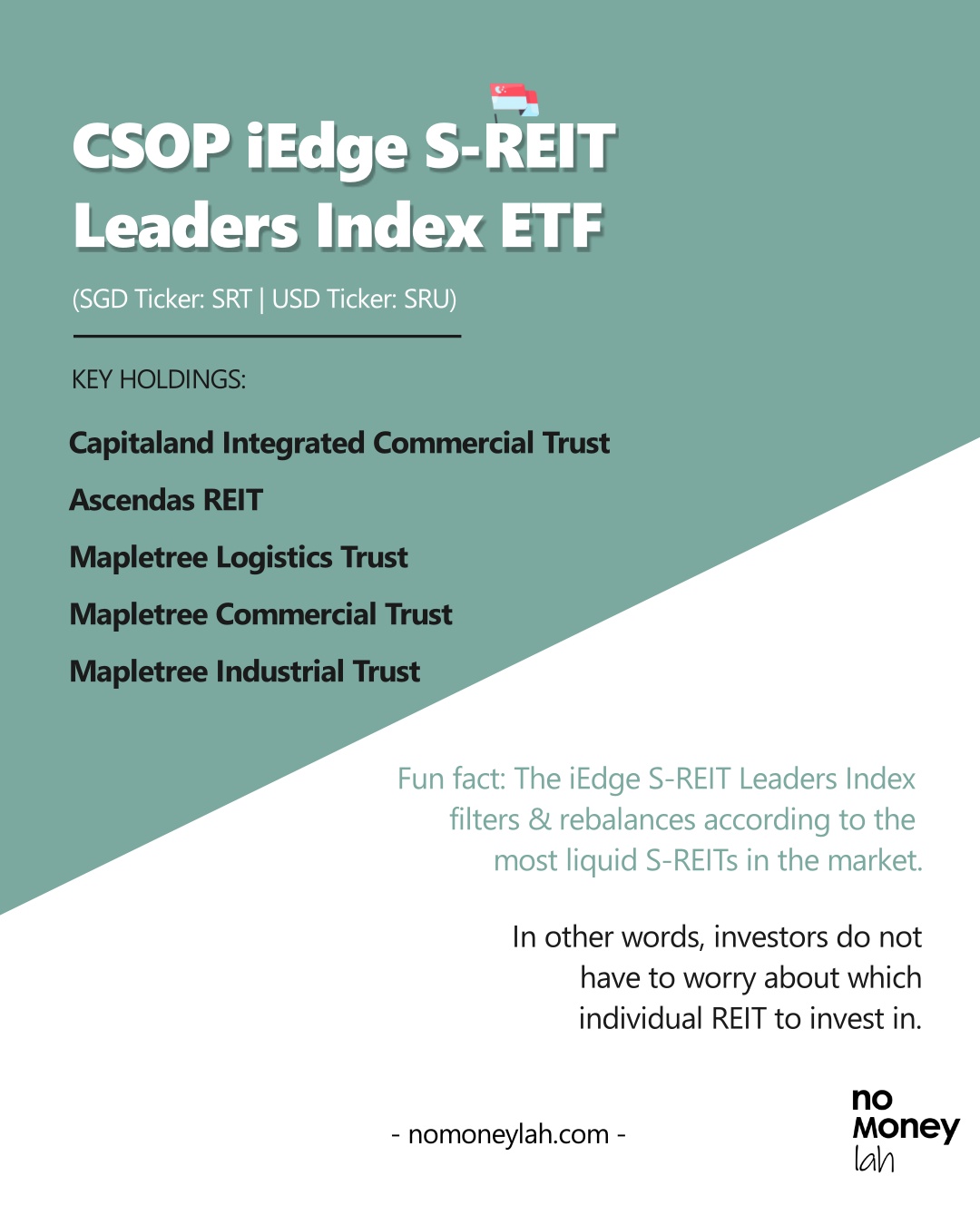

CSOP iEdge S-REIT Leaders Index ETF was launched in Nov 2021 to track the iEdge Leaders S-REIT Index top holdings are Singapores biggest industrial and office REITs. Stocks jump to close out second best week of 2022. ESR-Logos Reit was the only S-Reit which received both net institutional and retail inflows for Q1 2022.

If you click Accept Cookies or continue without changing your settings you consent to their use. SGX as of 30 September 2021 5 Source. SGXREIT trade ideas forecasts and market news are at your disposal as well.

Breaking News Jun 24 2022. Before you think about investing in the CSOP iEdge S-REIT Leaders Index ETF here are 4 things about the ETF that you should first know. To learn more about how we collect and use cookies and how you configure.

17-23-101 through 17-23-302 Office Information. 17-21-1101 through 17-21-1106 Uniform Partnership Act. Your REIT with Risk Management portfolio will always have a REIT allocation of at least 50.

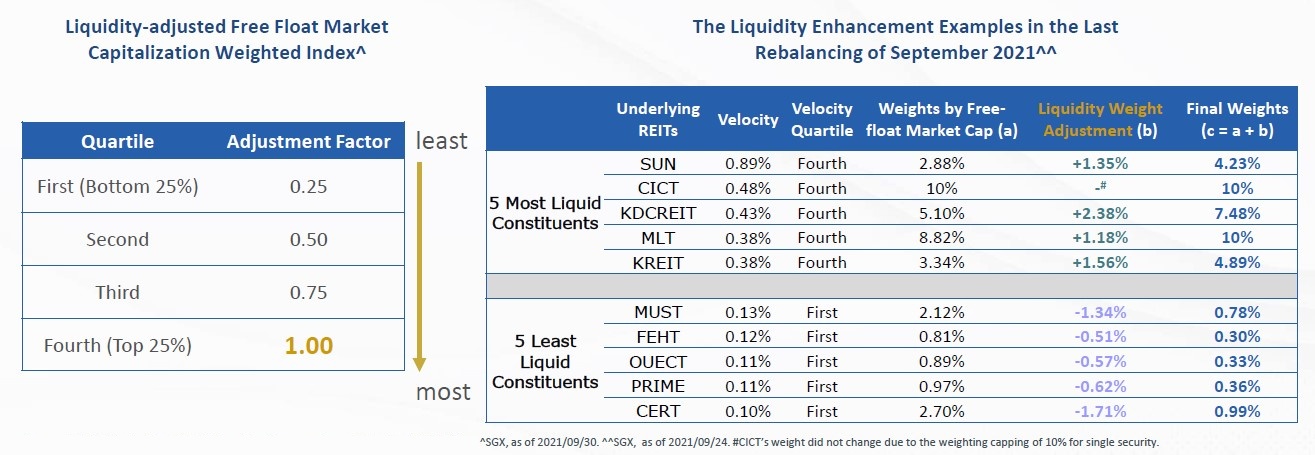

The ETF invests in a diversified basket of REITs listed on the SGX while aiming to replicate the performance of the SGX iEdge S-REIT Leaders Index a tradable liquidity-adjusted free-float. Come towards the end of November CSOP iEdge S-REIT Leaders Index ETF will start trading on the Singapore Exchange SGX. Herschler Building East 122 W 25th St Suites 100 and 101 Cheyenne WY 82002-0020.

The fund tracks the performance of the iEdge S-REIT Leaders Index which mostly comprises S-REITs. The iEdge S-Reit Index held resilient for the first half of 2022 generating flat total returns compared to the FTSE EPRA Nareit Developed Index a benchmark for global Reits which declined 18 per centDuring the period the S-Reits and property trusts sector in Singapore saw S359 million of net institutional outflows and S447 million of net retail inflowsHospitality. Theres going to be a new kid on the REIT ETF block giving investors another option to invest in Singapore REITs seamlessly.

The REIT component in this portfolio also tracks the SGXs iEdge S-REIT Leaders index. It saw S2 million of net institutional inflows and S10 million of net retail inflows. SGX as of 30 June 2021 6 Source.

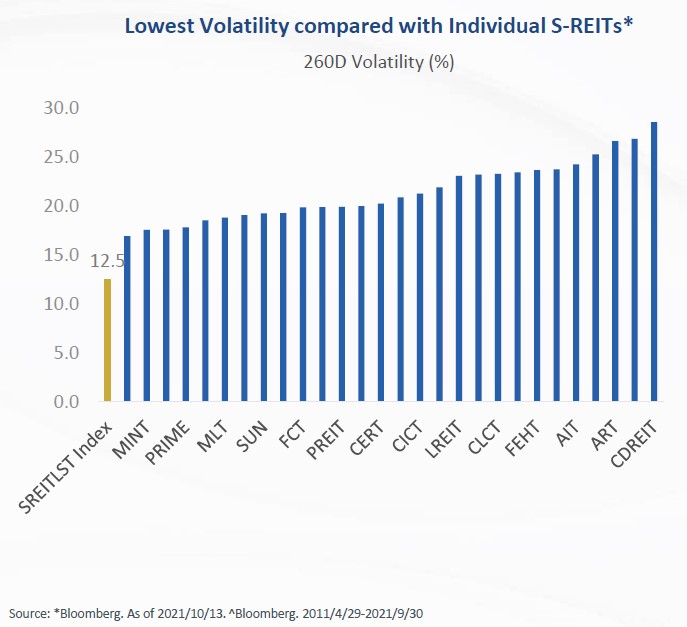

The iEdge S-REIT Leaders Index ETF is a diversified and return-focused ETF that provides investors with exposure to some of the most important uprising industries in real estate in different geographical locations with Singapore being the. SP 500 adds 31 Dow gains 823 points or 27 on Friday. Get detailed information on iEdge S-REIT Index REITSI including stock quotes financial news historical charts company background company fundamentals company financials insider trades annual reports and historical prices in the Company Factsheet.

CICT is in top position because of its office exposure. The funds manager applies an indexing-investment strategy or passive management to track its performance. Bloomberg CSOP 6 May 2016.

Heres the interesting thing compared to other REIT indices the index that CSOP follows iEdge Leaders S-REIT Index has a slightly. Get CSOP iEdge S-REIT Leaders Index ETF CSOP-SGSingapore Exchange real-time stock quotes news price and financial information from CNBC. The CSOP iEdge S-REIT Leaders Index ETF is a diversified and liquid instrument that offers investors a cost effective way to easily access the Singapore REITs market.

SGXREIT işlem fikirleri tahminler ve piyasa haberleri de sizin emrinizde. The iEdge S-REIT Leaders Index isnt new in fact it has been around since 2014. The iEdge S-Reit Index dipped 13 per cent in total returns in Q2 2022 while the sector as a whole saw S173 million of net institutional outflows and S282 million of net retail inflows.

SINGAPORE November 11 2021--CSOP Asset Management will list its second Exchange-Traded Fund ETF on SGX - CSOP iEdge S-REIT Leaders Index ETF Stock Code. Fundrise just delivered its 21st consecutive positive quarter. The CSOP iEdge S-REIT Leaders Index ETF is a sub-fund of the CSOP SG ETF Series I a Singapore unit trust.

Growth Track is SGX Groups podcast series where we focus on investment and growth opportunities across Asia. IEdge S-REIT Index - Singapore Exchange SGX We use cookies to ensure that we give you the best experience on our website. 17-30-101 through 17-30-1102 Statutory Trust.

IEdge S-REIT Leaders Index USD - Singapore Exchange SGX Loading. View live IEDGE S-REIT INDEX chart to track latest price changes. Lets find out more about this new exchange-traded fund ETF that tracks a real estate investment trust REIT.

Frasers Logistics Commercial Trust SGXBUOU 848 Weightage Previously known as Frasers Logistics Industrial Trust the enlarged REIT was formed as a result of a merger with Frasers Commercial Trust on 29 April 2020 and renamed as Frasers Logistics Commercial Trust with effect from 04 May 2020. The iEdge S-Reit Index dipped 13 per cent in total returns in Q2 2022 while the sector as a whole saw S173 million of net institutional outflows and S282 million of net retail inflows. 17-21-101 through 17-21-1003 Statutory Foundations.

It has delivered an annualised return of 992 in the past 5 years and a dividend yield last 12 months of 396. Find the latest information on iEdge REIT REITSI including data charts related news and more from Yahoo Finance. It saw S2 million of net institutional inflows and S10 million of net retail inflows.

En son fiyat değişikliklerini izlemek için canlı IEDGE S-REIT INDEX grafiğini görüntüleyin. Tune in to Growth Track Podcast. Ad Potentially Access Up To A 20 Tax Deduction On Qualifying Reit Income.

The REIT with Risk Management portfolio combines Singapore REIT with Singapore Government Bonds via the ABF Singapore Bond Index Fund. It is a market capitalisation weighted index that tracks the performance of the most liquid REITs in Singapore. The iEdge S-REIT Leaders Index is a narrow tradable adjusted free-float market capitalisation weighted index that measures the performance of the most liquid real estate investment trusts in Singapore in SGD.

Constituents Of The Iedge S Reit Index Companies Markets The Business Times

Reits Report Card 2021 How Singapore Reits Performed In 2nd Quarter 2021

Syfe Reit Vs Csop Iedge S Reit Leaders Index Etf Which Reit Investment Should You Choose

Does Inflation And Rising Interest Rate Affect Reits Featuring Csop Iedge S Reit Leaders Index Etf Edition

Csop Iedge S Reit Leaders Index Etf To List On Sgx

Csop Iedge S Reits Leaders Index Etf Riding The Wave With S Reits Leaders Youtube

Csop Iedge S Reit Leaders Index Etf Invest In This Etf For Stable Dividend Yield No Money Lah

Csop Iedge S Reit Leaders Index Etf What Investors Should Know About This New Reit Etf

Syfe Reit Vs Csop Iedge S Reit Leaders Index Etf Which Reit Investment Should You Choose

Csop Iedge S Reit Leaders Index Etf Invest In This Etf For Stable Dividend Yield No Money Lah

Index Update Sgx S Iedge S Reit 20 Index Will Become The Iedge S Reit Leaders Index

Csop Iedge S Reit Leaders Index Etf Poems

Csop Iedge S Reit Leaders Index Etf Invest In This Etf For Stable Dividend Yield No Money Lah

S Reit Report Card Here S How Singapore Reits Performed In Fy2018

Csop Iedge S Reit Leaders Index Etf What Investors Should Know About This New Reit Etf

Csop Iedge S Reit Leaders Index Etf Invest In This Etf For Stable Dividend Yield No Money Lah

Csop Iedge S Reit Leaders Index Etf Invest In This Etf For Stable Dividend Yield No Money Lah

4 Things About The Csop Iedge S Reit Leaders Index Etf Srt Sru To Know Before Investing

Syfe Reit Vs Csop Iedge S Reit Leaders Index Etf Which Reit Investment Should You Choose

Comments

Post a Comment